India Form of Receipt for the Surrender Value of Policy 2001-2025 free printable template

Show details

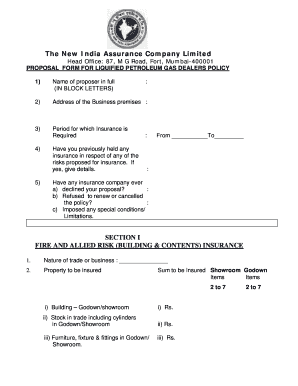

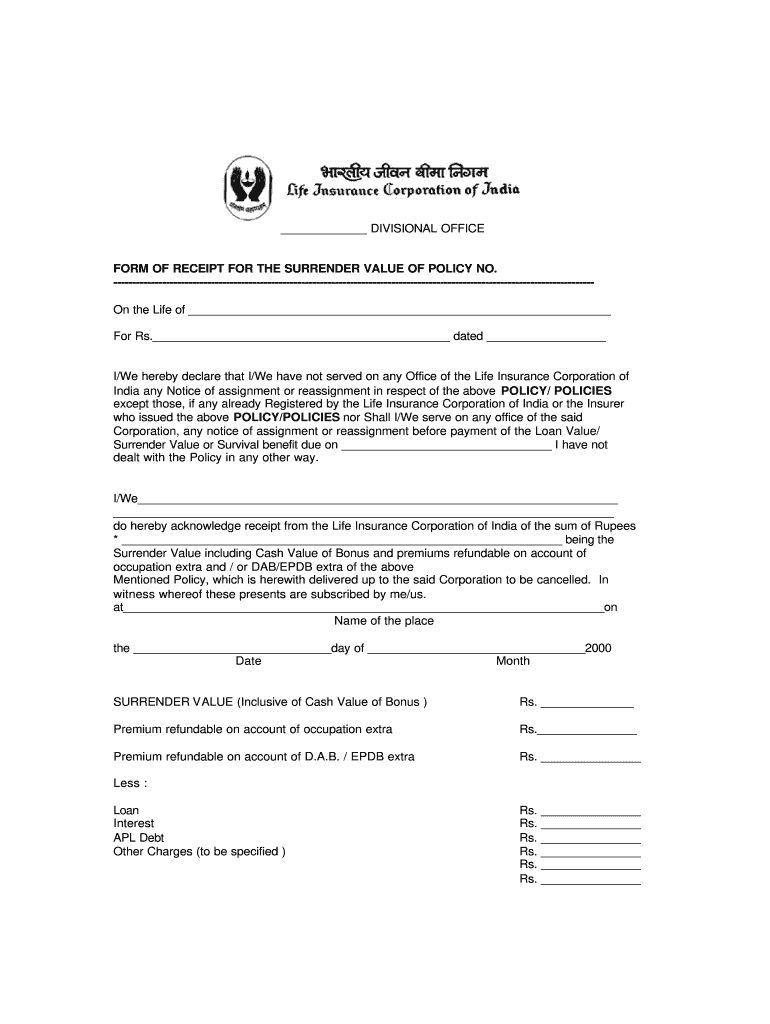

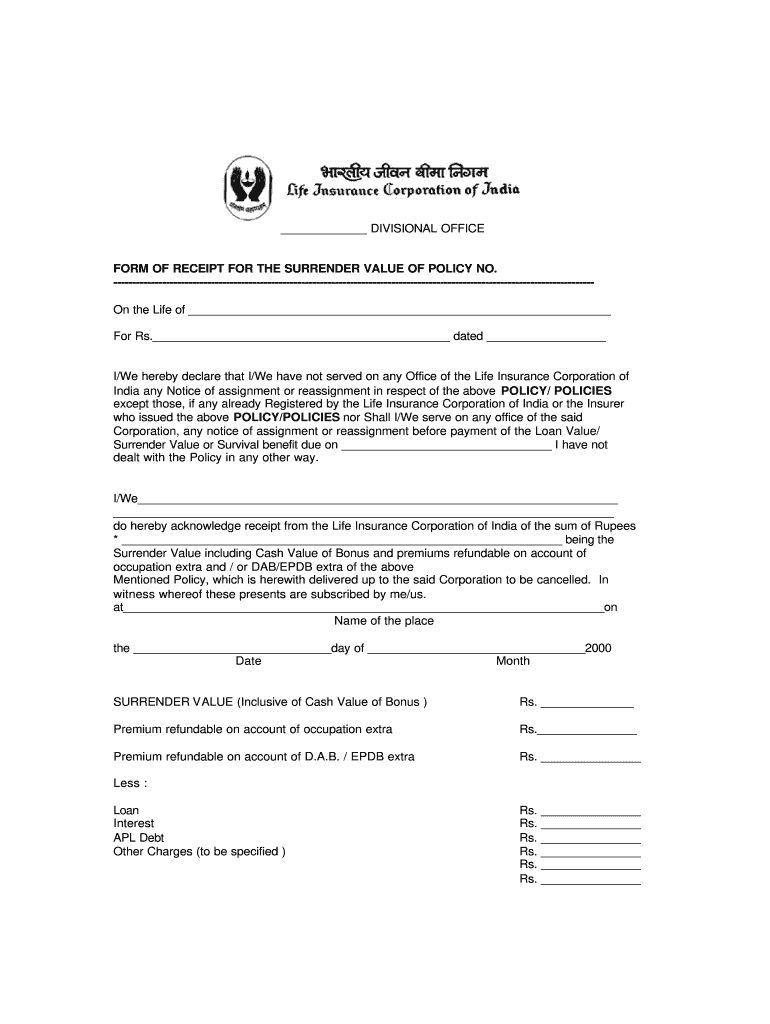

DIVISIONAL OFFICE FORM OF RECEIPT FOR THE SURRENDER VALUE OF POLICY NO. -------------------------------------------------------------------------------------------------------------------------------On

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign lic form 5074

Edit your lic surrender questionnaire form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your lic 3510 form form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit form surrender lic online

Follow the steps below to benefit from a competent PDF editor:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit surrender form lic. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

It's easier to work with documents with pdfFiller than you could have believed. You may try it out for yourself by signing up for an account.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out lic cylinder form

How to fill out India Form of Receipt for the Surrender Value of Policy

01

Obtain the India Form of Receipt for the Surrender Value of Policy from your insurance provider.

02

Fill in your policy number in the designated field.

03

Provide your personal details including name, address, and contact information.

04

State the reason for surrendering the policy.

05

Indicate the date of surrender.

06

Sign the form to confirm your request.

07

Submit the completed form along with any required documentation to your insurance company.

Who needs India Form of Receipt for the Surrender Value of Policy?

01

Policyholders who wish to surrender their insurance policy to receive its surrender value.

Video instructions and help with filling out and completing lic surrender form

Instructions and Help about lic surrender application

Fill

form surrender policy download

: Try Risk Free

People Also Ask about lic surrender certificate

How much money will I get if I surrender my LIC policy after 7 years?

Guaranteed Surrender Value: As the name suggests, this is a portion of money that is payable to the policyholder if he/she volunteers to surrender the LIC policy. Guaranteed surrender value is essentially 30% of the overall premiums that you have paid so far.

How much money will I get if I surrender my LIC policy?

Payment In Case Of Surrender If you surrender after 3 years, the surrender value will be around 30% of the premiums paid till date. However, this is excluding the premium paid in the first year and the premiums paid towards accidental benefit riders.

Can I close my LIC before maturity?

LIC only offers surrender value after you've been paying premiums for 3 years. If you've been paying premiums for less time than that, you can still surrender your policy, but you won't get any money for it. Find your original policy bond. You will need to send a copy of it with your request to surrender your policy.

Can I surrender LIC policy online?

You can download the surrender form from the official website of the company. Fill this form and submit it to the local branch of LIC along with the surrender or cancellation form, you must submit the following documents: Original documents of the policy. A canceled cheque.

How can I surrender my LIC policy?

How to Cancel LIC policy? Visit the nearest LIC branch and avail a surrender discharge voucher. Form 5074 is the surrender discharge voucher. Fill the form 5074 and submit it with the relevant documents. Or else, courier the filled form along with relevant documents to the LIC's head office. The process will begin.

How much money will I get if I surrender my LIC policy after 5 years?

Special Surrender Value If in case, the insurance holder has paid premiums for more than 4 years and less than 5 years, then 90% of the complete maturity sum is provided. If the policyholder is paying premiums for more than 5 years, then he/she receives 100% of the sum assured (maturity amount).

How much money will I get if I surrender my LIC policy after 10 years?

Total bonus accrued = ((50 x 10,00,000/1,000) x 10) which equals Rs. 5,00,000. The guaranteed surrender value factor for a policy term of 20 years and policy surrender in the 11th year is 60% (as mentioned in LIC New Jeevan Anand's brochure).

How much money will I get if I surrender my LIC policy before 1 year?

LIC's Rules About Policy Surrender You will not get any of the premium amounts paid in the first year in your surrender value. In general, the surrender value is returned to the policyholder at 30% of the premium amount.

Our user reviews speak for themselves

Read more or give pdfFiller a try to experience the benefits for yourself

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I make edits in lic sv form without leaving Chrome?

Install the pdfFiller Google Chrome Extension in your web browser to begin editing form 5074 lic and other documents right from a Google search page. When you examine your documents in Chrome, you may make changes to them. With pdfFiller, you can create fillable documents and update existing PDFs from any internet-connected device.

How do I edit lic policy form on an iOS device?

Create, modify, and share lic surrender using the pdfFiller iOS app. Easy to install from the Apple Store. You may sign up for a free trial and then purchase a membership.

Can I edit form information on an Android device?

Yes, you can. With the pdfFiller mobile app for Android, you can edit, sign, and share surrender policy form on your mobile device from any location; only an internet connection is needed. Get the app and start to streamline your document workflow from anywhere.

What is India Form of Receipt for the Surrender Value of Policy?

The India Form of Receipt for the Surrender Value of Policy is a document issued by an insurance company to acknowledge the receipt of the policyholder's request to surrender their insurance policy in exchange for its cash value.

Who is required to file India Form of Receipt for the Surrender Value of Policy?

The policyholder who wishes to surrender their insurance policy and claim the surrender value is required to file the India Form of Receipt.

How to fill out India Form of Receipt for the Surrender Value of Policy?

To fill out the India Form of Receipt for the Surrender Value, the policyholder must provide their personal information, policy details, the reason for surrendering the policy, and sign the form to authorize the transaction.

What is the purpose of India Form of Receipt for the Surrender Value of Policy?

The purpose of the India Form of Receipt for the Surrender Value of Policy is to provide a formal acknowledgment from the insurance company that the policyholder has surrendered their policy and to outline the surrender amount being processed.

What information must be reported on India Form of Receipt for the Surrender Value of Policy?

The information that must be reported includes the policyholder's name and contact details, the policy number, the date of surrender, the amount of surrender value, and any specific terms or conditions associated with the transaction.

Fill out your India Form of Receipt for form Surrender Value of Policy online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Surrender Form 5074 is not the form you're looking for?Search for another form here.

Keywords relevant to lic exit form

Related to lic surrender forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.